Hudson Yards Takes A Bite of The Big Apple

AUGUST 27, 2017

Rarely does one project redefine a city. For this to occur in New York, the capital of capital, such a project must be significant. This project is Hudson Yards.

New Yorker’s are traditionalists but they also seek fresh experiences, which is why Hudson Yards’ clever recycling of an under utilized rail yard makes for the perfect new Manhattan neighbourhood. They are calling it a “Life Maximizer Destination”

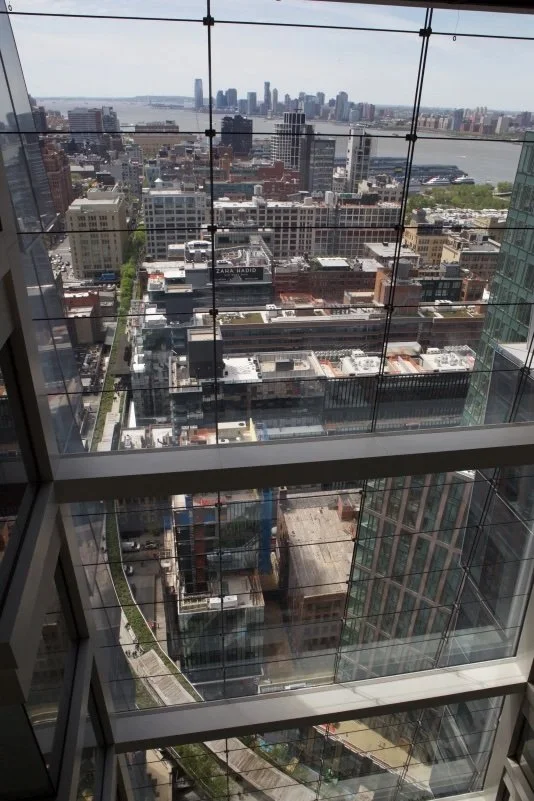

The rejuvenation of Hudson yards is as significant to New York, as Barangaroo is to Sydney. It comprises the redevelopment of 11 hectares of waterfront land on the west of the city, around Chelsea and popular tourist attraction, the High Line. It is immediately north of the Meatpacking district and west of Penn Station and Madison Square Garden.

Hudson Yards is a dream project conjured up by an active and invested City, State and Metropolitan Transport Authority. Its purpose has been to stimulate development of Midtown South Manhattan, west towards the Hudson River. However, as we have learned with property development, timing is critical to success.

The rights to develop were launched at the worst time, March 2008, during the global financial crisis or as New Yorkers call it “The Great Recession”. Whilst not initially successful in their bid, US property developer Related Properties teamed up with Goldman Sachs to take over the project. Goldman’s had experience with these government deals, creating their new headquarters at 200 West St, on the Hudson, with the New York and New Jersey Port Authority. They had taken advantage of a $1.5 billion city loans and tax minimization benefits to build their new $2 billion HQ.

Later, the Canadian pension fund, Oxford Properties, would get involved. The result? The conversion of an old rail yard to a modern multiuse city. It comes at a time when there is prosperity and confidence in the city that claims it is the global financial nucleus.

Hudson Yards is like Sydney’s Barangaroo in so many ways. Both projects have sought to ignite forgotten or underutilized water frontages in the city. They have improved public access, encouraged better public transport and revitalized their precincts. Both show that docks for unloading ships (Barangaroo) and yards for storing train carriages (Hudson Yards) are no longer the right purposes of valuable city land. By their nature, both are significant in scale and even though both are incomplete, have attracted the city’s occupants and are now commonly considered as draw card locations.

Both projects have dealt with multiple land uses and their integration into building one brand. They also acknowledge the attraction of workers wanting to live closer to jobs, with many jobs now centralizing in global cities. Their multi use solutions, which integrate retail, residential, office and tourism, work well by de-risking the overall project. Office space is expensive to build but throws off long-term income, whereas residential development can provide an immediate and in some cases early payback. Retail and Tourism keep the crowds coming and that brings immediate and long-term cash flow. In other words, this mix provides almost the ideal repayment coverage of debt.

Both projects have dealt with perceived locational inferiority by upscaling the quality of the buildings. The master planning has shown the true value of commitment, perseverance and patience. Fortune does favour the brave and in Sydney and New York it is necessary to encourage entrepreneurial spirit.

Hudson Yards has attracted corporate heavyweights to occupy it’s office spaces: Blackrock HBO, CNN, Time Warner, Coach, L’Oreal, SAP, DNB, Warner Brothers, Wells Fargo, Neimen Marcus, Point 72 and others.

Barangaroo has attracted: PWC, KPMG, Westpac, HSBC, LendLease, Mercer, Accenture and others.

Barangaroo

Hudson Yards

Hudson Yards will comprise of 11 hectares,

16 skyscrapers offering about 1.2million m2.

Barangaroo comprises of about 22 hectares,

5 skyscrapers and offering about 500,000 m2

It is fascinating how it is the governments of these cities who have kick-started the change and how private enterprise has supported the effort to help commercialize the projects. Both these projects are significant and will shift the focus of the cities for years to come, or until something more significant arrives.

Thanks to my Newmark, Grubb Knight Frank colleagues, Joey Vlasto and Neil Goldmacher for arranging my site inspection of Hudson Yards.

For more information on the Hudson Yards Project, click here